All posts by category: Economic and Social Development

Chapter 10 – Income, Health, and Fertility: Convergence Puzzles – Highlights

Union finance minister Arun Jaitley tabled the Economic Survey 2016-17 in Parliament during the first day of the budget session. Here are the major highlights from Chapter 10 of Economic Survey 2016-17. Despite rapid overall growth, there is striking evidence of divergence, or widening gaps in income and consumption across the Indian states, in sharp […]

Chapter 11 – One Economic India – Highlights of Economic Survey 2016-17

This chapter of the Economic Survey 2016-17 is an attempt to assess the extent to which India can bring the idea of “ONE ECONOMIC INDIA“, similar in tune to the affirmed political “idea of India,”. The assessment is based primarily on data based and juridical analysis of Indian economy and laws and thus, definitely makes […]

Chapter 12 – India on the Move and Churning – Highlights of Economic Survey 2016-17

Chapter 12 of the Economic Survey 2016-17 talks about labour migration and the prevailing economic conditions in the country. The Economic Survey conducts an extensive study to arrive upon various conclusions. This chapter is not that important for UPSC Prelims, but topics such as migration, urbanization, female labour force etc can be a part of […]

Chapter 13 – The ‘Other Indias’ – Highlights of Economic Survey 2016-17

Chapter 13 of the Economic Survey 2016-17 focuses upon various development models found in India and how far states have progressed since Independence. The survey here notes that the government has been less than efficient in providing redistributive justice and promoting social welfare. Economic Survey 2016-17 identifies three successful models of development found in Peninsular […]

Chapter 14 – From Competitive Federalism to Competitive Sub-Federalism – Highlights of Economic Survey 2016-17

Chapter 14 of the Economic Survey 2016-17 focuses on attempt to make cities entrusted with responsibilities, empowered with resources, and encumbered by accountability so as to make them effective vehicles for competitive federalism and, indeed, to unleash competitive sub federalism. What’s Competitive sub federalism according to economic survey 2016-17? The term ‘competitive sub – federalism’ […]

WHAT IS GST AND HOW GST WORKS – EXPLAINED WITH INFOGRAPHICS

What is GST? GST or Goods and Services tax is an Indirect tax system, soon to be introduced in India. The GST tax reform was passed by both houses of parliament as the 101st Constitutional Amendment Act. With the introduction of GST India is stepping into a new dawn of taxation regimes. What happens when GST […]

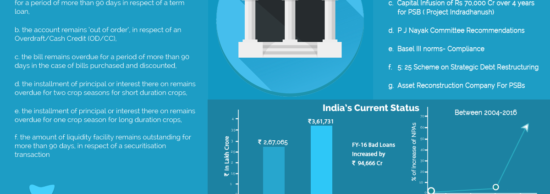

BAD LOAN MENACE

An NPA or a Non-Performing Asset is a loan that is on the verge of default by the borrower. As per Indian rules, if the repayment of a loan is delayed beyond 90 days, the loan must be recognized as a default and an NPA or Non-performing asset. The gross NPAs in India were 5.1% […]

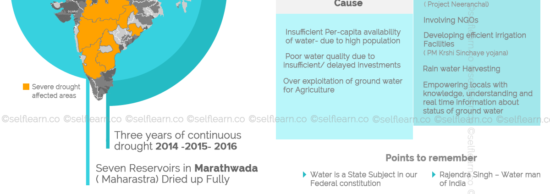

WATER CRISIS IN INDIA

Water Crisis in India About 330 million people in India has been facing severe droughts issues this year. The coal-fired power plants-the major source of India’s electricity are facing huge deficits of water, resulting in energy crisis. The height of the issue can be understood for the government’s order to appoint armed guards to prevent […]

All you want to know about- Goods and Services Tax or GST

GST, the single tax to be levied on goods and services is biggest of the recent tax reforms in India. It will prove a paradigm shift from the old burdensome indirect tax system that we practiced and will help India to achieve international standards in indirect taxation regime. Unlike many other countries, we follow a […]

Login

Login